- Date

CCPA vs CPRA Unpacking California's Privacy Laws

Andrii Romasiun

Andrii Romasiun

Let's clear up one of the most common points of confusion right away: The California Privacy Rights Act (CPRA) isn't a separate law that replaced the California Consumer Privacy Act (CCPA). Instead, think of the CPRA as a major upgrade—an amendment that builds on the CCPA's foundation to give consumers significantly more control over their personal data.

The Evolution from CCPA to CPRA Explained

When the CCPA first rolled out on January 1, 2020, it was a landmark moment for data privacy in the United States. For the first time, California residents had foundational rights to know what data companies collected about them, demand its deletion, and opt out of its sale. The law targeted businesses with over $25 million in gross revenue or those handling the personal information of 50,000 or more consumers.

But it didn't take long for the digital world to find the gaps. Businesses quickly discovered they could sidestep the definition of a "sale" by sharing data for targeted advertising without a direct monetary transaction. This meant that even if you opted out of your data being sold, it could still be passed along to third-party advertisers for what's known as "cross-context behavioral advertising."

Why the Upgrade Was Necessary

That loophole was a big one, and it highlighted the need for a stronger, more modern privacy framework. The CPRA was drafted specifically to patch these holes and bring California’s standards closer to global regulations like the GDPR. The goal was to add more specific protections, clean up ambiguous language, and, crucially, create a dedicated agency to make sure the rules were followed.

This shift from CCPA to CPRA represents a huge leap forward in data privacy, focusing on a few key improvements:

- Closing Loopholes: The CPRA gets specific, calling out data "sharing" for advertising, not just "selling."

- Introducing New Rights: Consumers now have the right to correct inaccurate information and limit how businesses use a new category of "Sensitive Personal Information."

- Establishing a Regulator: The new California Privacy Protection Agency (CPPA) was created to provide dedicated oversight and enforcement.

A High-Level Comparison

To really see how the landscape changed, it helps to put the two frameworks side-by-side. The table below offers a quick glance at the most significant upgrades the CPRA brought to the table.

CCPA vs CPRA High-Level Summary of Changes

| Feature | CCPA (The Original) | CPRA (The Upgrade) |

|---|---|---|

| Primary Scope | Governed the "sale" of personal information. | Expanded scope to include both "sale" and "sharing" of personal information. |

| Consumer Rights | Right to know, delete, and opt out of sale. | Added the Right to Correct and the Right to Limit Use of Sensitive Personal Information. |

| Enforcement Body | Enforced by the California Attorney General. | Established the dedicated California Privacy Protection Agency (CPPA). |

| Cure Period | Provided a mandatory 30-day period to fix violations. | Made the 30-day cure period discretionary, increasing compliance risk. |

As you can see, the CPRA didn't just tweak the original law—it fundamentally expanded its scope and gave it real teeth. The introduction of "sharing" and the creation of a dedicated enforcement agency were game-changers for how businesses have to approach data privacy in California and beyond.

Navigating the New Business Compliance Thresholds

One of the biggest practical differences between the CCPA and CPRA is who has to follow the rules. The CPRA tweaked the compliance thresholds, essentially changing the definition of which businesses fall under the law's jurisdiction. The goal was pretty clear: ease the pressure on smaller companies while zeroing in on larger operations and businesses built on data.

Under the original CCPA, a business was on the hook if it met just one of three criteria:

- Grossed over $25 million in annual revenue.

- Handled the personal information of 50,000 or more consumers, households, or devices each year.

- Made 50% or more of its annual revenue from selling consumers' personal information.

The Shift in Data Volume Thresholds

The CPRA made a crucial update here by doubling the data volume threshold. The magic number jumped from 50,000 consumers or households to 100,000. This change was a huge sigh of relief for many small to medium-sized businesses that process a fair amount of data but aren't operating at a massive scale.

What does this mean in the real world? A small e-commerce shop or a niche SaaS provider might now be exempt, as long as they don't meet the other two conditions. Still, you can't just set it and forget it. Any growing business needs to keep a close eye on its data processing, because hitting that new 100,000-consumer mark can happen faster than you think. For a closer look at how these rules impact smaller ventures, our guide on privacy-first analytics for small businesses is a great resource.

Introducing the Concept of Data Sharing

This next change is arguably even more important. The CPRA expanded its scope by adding the word "sharing" right next to "selling." This was a calculated move to plug a major loophole in the CCPA. Before, companies could trade data for things like cross-context behavioral advertising without any money changing hands, letting them argue it wasn't technically a "sale."

The CPRA shut that door. The law now covers any business that gets 50% or more of its annual revenue from either selling or sharing personal information. This update brings a huge swath of modern digital advertising practices directly into the regulatory fold.

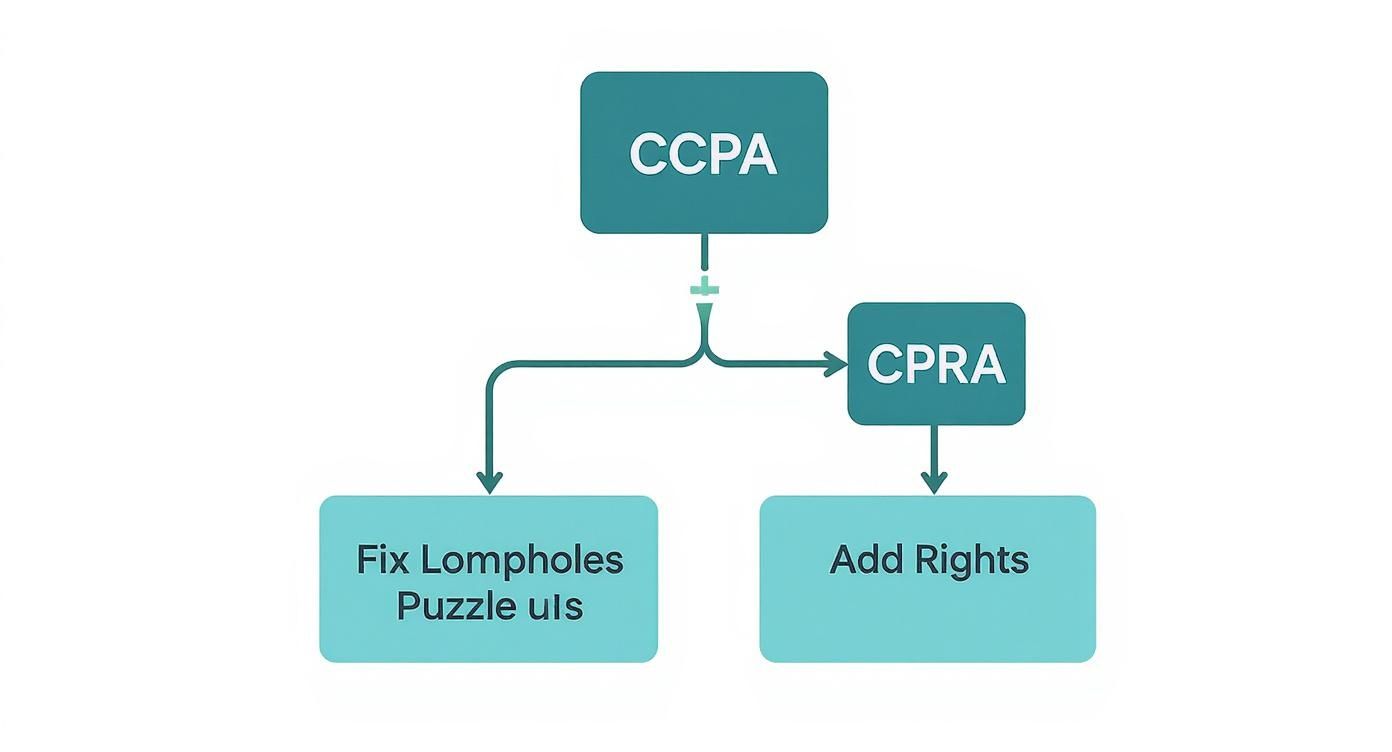

This infographic does a great job of showing how the CPRA builds on the CCPA's foundation, patching up loopholes and introducing new rights for consumers.

As you can see, the CPRA isn't a total rewrite but a strategic upgrade designed to fix the gaps that emerged in the original law.

Ultimately, the threshold changes are a big deal. By raising the consumer data count to 100,000 and expanding the definition of data transactions to include 'sharing' for ad-targeting purposes, the CPRA reflects a smarter approach to regulating today's data economy. The new rules are recalibrated to capture the data practices that matter most, especially in the world of digital advertising. For more details on this, you can find further insights about these updated compliance criteria on wplegalpages.com.

Comparing the Expanded Consumer Rights

The California Privacy Rights Act (CPRA) did more than just fine-tune the CCPA—it introduced entirely new consumer rights, fundamentally shifting the power dynamic between individuals and the businesses that handle their data. While the CCPA laid the foundation, the CPRA built a much stronger structure on top of it. This expansion is at the heart of the CCPA vs CPRA conversation.

The original CCPA granted consumers the rights to know, delete, and opt out of the sale of their data. The CPRA kept these core pillars but added two significant new rights that tackle more nuanced privacy issues: the ability to fix incorrect information and the power to restrict how a new, more protected class of data is used.

The New Right to Correct Inaccurate Information

One of the most practical and frankly, long-overdue additions is the Right to Correct. Before CPRA, a consumer's only real recourse for bad data was to ask a business to delete their entire profile. This often created frustrating situations where something as simple as a misspelled name, an old address, or an inaccurate credit detail could linger and cause real-world headaches.

Now, under the CPRA, if you find a business is holding inaccurate personal information about you, you can file a verifiable request to get it corrected. Businesses are now obligated to apply "commercially reasonable efforts" to fix those errors.

Think about a customer who recently moved. Their old shipping address is still on file with an e-commerce store, causing packages to go missing. With the Right to Correct, that person can formally request an update, and the business has a legal duty to make it happen. It's a simple but powerful right that boosts data integrity and smooths out customer experiences.

The Right to Limit Sensitive Personal Information

Perhaps the most impactful expansion of rights comes from the CPRA's creation of Sensitive Personal Information (SPI). This is an entirely new category of data that gets a higher level of protection simply because its misuse or exposure could create significant harm for an individual.

What is Sensitive Personal Information (SPI)?

SPI covers things like your Social Security number, driver's license, precise geolocation, racial or ethnic origin, religious beliefs, genetic data, biometric information, and even the contents of private communications like your emails and text messages.

The CPRA gives consumers the powerful Right to Limit the Use and Disclosure of SPI. This allows you to tell a business to only use your sensitive data for the core purpose of providing the product or service you asked for. They can't turn around and use that same information for other things, like ad targeting, without getting your explicit go-ahead.

How SPI Limitation Works in Practice

Imagine you use a fitness app that tracks your location to map your morning runs. Under the CPRA, you can direct that app to use your precise geolocation data only for tracking your workout. The company would then be prohibited from using that same location data to push targeted ads for a nearby gym or smoothie shop.

This right forces businesses to add a clear link to their website, typically titled "Limit the Use of My Sensitive Personal Information," making it easy for consumers to exercise this control. From an operational standpoint, this is a heavy lift for companies. It requires them to meticulously map their data flows to ensure they can properly segregate SPI and honor these limitation requests.

The table below breaks down these newly added consumer rights, showing the clear evolution from the CCPA framework. A transparent and detailed privacy policy, like the one outlined in our own Swetrix data policy, is essential for communicating these rights to users.

Expanded Consumer Rights Under CPRA

The shift from CCPA to CPRA is most visible in the consumer rights it added or strengthened. Here’s a side-by-side look at what changed.

| Consumer Right | Available under CCPA? | Key Enhancements or Additions in CPRA |

|---|---|---|

| Right to Correct | No | Grants consumers the ability to request correction of inaccurate personal information held by a business. |

| Right to Limit Use of SPI | No | Allows consumers to restrict the use and disclosure of their Sensitive Personal Information to necessary purposes only. |

| Right to Know | Yes | Expanded to cover information that is "shared" in addition to "sold," and extends the look-back period for data requests. |

| Right to Opt-Out | Yes | Broadened from just opting out of "sale" to opting out of both the "sale and sharing" of personal data for advertising. |

Ultimately, these expanded rights give consumers far more granular control, moving beyond simple deletion or opt-out requests into more sophisticated management of their personal data.

The New Sheriff in Town: CPPA and Ramped-Up Enforcement

One of the biggest shifts when comparing CCPA vs CPRA is how the rules are actually enforced. The CPRA didn't just tweak the existing law; it introduced a brand-new agency to enforce it. This move from a more passive enforcement model to an active one completely changes the game for any business that deals with data from California consumers.

Under the old CCPA, enforcement was left entirely to the California Attorney General's office. While the AG's office did what it could, it was juggling countless other responsibilities. Privacy enforcement was just one file in a very large cabinet, which often meant they could only react to problems, not proactively hunt for them.

Enter the California Privacy Protection Agency

The CPRA created the California Privacy Protection Agency (CPPA), the very first US agency of its kind, dedicated solely to data privacy. This was a massive signal. Instead of just responding to complaints, the CPPA has the power to launch its own investigations, perform audits, and hand out fines whenever it sees fit.

The CPPA’s power comes from a two-pronged approach that makes it incredibly effective:

- Enforcement: It has the full authority to investigate violations and impose some hefty financial penalties.

- Rulemaking: It’s also in charge of updating the regulations, which allows it to close loopholes and keep the law relevant as technology evolves.

This dual role is key. The CPPA doesn't just play by the rules; it helps write them. For businesses, this means you can't just set up a compliance program and forget it. You have to stay on your toes.

The Disappearing "Get Out of Jail Free" Card

For many businesses, the most nerve-wracking change was getting rid of the CCPA’s mandatory 30-day cure period. Before, if you were caught out of compliance, you automatically got 30 days to fix the issue before fines could be levied. It was a crucial safety net.

The CPRA snatched that safety net away. The 30-day cure period is now discretionary. This means the CPPA gets to decide, on a case-by-case basis, if you deserve a chance to fix your mistake. The pressure is now entirely on you to be compliant from the get-go.

The CPPA can look at things like a company's intent or its past compliance record when deciding whether to grant a cure period. This completely flips the script from "fix it if you get caught" to "get it right, or else."

This new reality raises the stakes considerably. You can't afford to wait for a warning shot anymore. Your privacy program has to be solid and operational from day one to avoid getting hit with immediate fines.

Higher Fines, Higher Stakes

The CPRA also cranked up the financial penalties. The standard fine still sits at $2,500 per violation, but if the violation involves data from a minor under 16, that penalty triples to $7,500 per violation. If you're dealing with data from thousands—or millions—of users, you can see how quickly those numbers could become catastrophic.

With the CPRA, the entire enforcement landscape has been redrawn. The CPPA is a proactive regulator with the authority to audit businesses and issue penalties up to $7,500 per violation, creating a serious financial threat. Making the cure period optional forces companies into a constant state of readiness, establishing a tough new benchmark for data privacy in the United States. You can find more details about the CPPA's enforcement powers on consentik.com.

At the end of the day, the creation of the CPPA and the elimination of the automatic cure period send a powerful message. California is dead serious about data privacy, and the consequences for not meeting the CPRA's standards are now faster and more severe than ever before.

How CPRA Impacts Digital Marketing and Analytics

When you look at the real-world impact of CCPA vs CPRA, one word changes everything for digital marketers and data analysts: "sharing." The original CCPA zeroed in on the "sale" of data, a term many companies interpreted in the strictest sense—a direct transaction for money. This left a massive loophole for some of the most common marketing tactics out there.

CPRA slammed that loophole shut. It introduced the concept of "sharing" personal information specifically for cross-context behavioral advertising. This move puts a regulatory lens on the very engine of modern digital advertising, from retargeting campaigns to building custom audiences with third-party data.

Think about it this way: if your e-commerce store passes visitor data to an ad network so you can show them ads on other websites, that's now covered by CPRA. It doesn't matter if you paid for the ads, not the data itself—it’s considered "sharing."

New Requirements for Consent and Opt-Outs

Because the definition of data use has expanded, your consent management has to evolve, too. Under CPRA, you can't just hide the opt-out for data sharing deep inside a privacy policy anymore. You're required to give consumers a clear, easy-to-find link to opt out.

Practically speaking, the old "Do Not Sell My Personal Information" link is obsolete. It now needs to read "Do Not Sell or Share My Personal Information." It might seem like a small wording tweak, but it carries significant weight for your website's user experience and compliance framework.

The CPRA effectively gives consumers a specific choice about whether their online behavior can be tracked across different sites and apps for advertising. This is now a distinct right, separate from opting out of a direct data sale.

Adjusting Your Analytics and Marketing Stack

This shift is forcing marketing teams everywhere to take a hard look at their analytics and advertising tools. Any platform that leans heavily on third-party cookies and cross-site tracking has become a compliance minefield.

Here are a few common practices now squarely in the CPRA's crosshairs:

- Retargeting: When you show ads to someone who visited your site but didn't buy anything, you're "sharing" their data with the ad network. It's a textbook example.

- Lookalike Audiences: Building new audiences by matching traits of your existing customers almost always involves sharing data with major ad platforms.

- Third-Party Pixels: That tracking pixel from a social media platform? If it collects data to fuel its own advertising machine, that's a clear instance of data sharing.

The only way forward is to prioritize tools that are built with privacy in mind from the ground up. As the industry marches toward a cookieless future, embracing privacy-friendly analytics isn't just a nice-to-have; it's a fundamental compliance strategy. These tools provide the insights you need without triggering the cross-context behavioral advertising rules that CPRA was designed to regulate.

Ultimately, the CPRA is pushing marketing and analytics teams toward greater transparency and purpose. Long-term success now hinges on earning consumer trust with clear consent choices and focusing on first-party data, not on the murky data-sharing ecosystem of the past. It’s a necessary shift toward a more sustainable and ethical way of doing business online.

Your Action Plan for CPRA Compliance

https://www.youtube.com/embed/Qlf7oU2PEaA

Knowing the differences in the CCPA vs CPRA debate is one thing, but actually putting that knowledge into practice is a whole different ballgame. Moving from theory to action demands a clear, methodical plan to make sure your business is buttoned up and meeting its new obligations. This guide breaks down the essential steps to get your compliance efforts organized and reduce your risk under the expanded law.

Your first, and most critical, step is to get a handle on your data. You can't protect what you don't know you have. This means rolling up your sleeves and conducting a thorough data inventory and mapping exercise. You'll need to identify every single piece of personal information your business collects, processes, and stores, paying extra close attention to the new category of Sensitive Personal Information (SPI).

This audit needs to be detailed. Document where the data comes from, why you're collecting it, who has access to it, and where it goes. Without this complete picture, you’ll be flying blind when it comes to managing consumer rights requests and applying the right protections.

Update Your Privacy Policies and Disclosures

Once you have a clear data map, it's time to tackle your privacy policies. These documents are no longer just legal boilerplate; they need to reflect the new rights and definitions the CPRA brings to the table. Ambiguity is your enemy here—your policies have to be explicit and written in a way that the average person can actually understand.

Your updated privacy policy must include:

- Clear Disclosures: State outright whether you sell or share personal information, and that includes sharing for cross-context behavioral advertising.

- Retention Schedules: You need to disclose how long you keep each category of personal information and justify the business reason for that specific retention period.

- SPI Information: Spell out the categories of Sensitive Personal Information you collect and explain exactly what you're using them for.

One of the most visible changes you need to make is on your website. The old "Do Not Sell My Personal Information" link must now read "Do Not Sell or Share My Personal Information." You also have to add a separate, easy-to-find link for consumers to "Limit the Use of My Sensitive Personal Information."

Implement Mechanisms for New Consumer Rights

The CPRA gives consumers new rights, which means you need new internal processes to honor them. Your team has to be ready to handle requests for both the Right to Correct inaccurate information and the Right to Limit the Use of SPI. This isn't just about adding a button to your website; it requires solid back-end procedures to verify, process, and track every request from start to finish.

Consider these action items:

- Develop Verification Procedures: Set up a secure and reliable way to confirm the identity of anyone making a rights request. You don't want to give data to the wrong person.

- Create Internal Workflows: Map out the step-by-step process your team will follow to correct data or limit SPI use across all your systems. Document everything.

- Train Your Staff: Anyone who touches consumer data needs to be trained on these new rights and the exact procedures for fulfilling them.

Finally, you absolutely must review your third-party vendor contracts. Under the CPRA, you’re on the hook for what your service providers do with the data you give them. Your contracts need to explicitly state that vendors must comply with CPRA, define the exact purpose for any data processing, and give you the right to audit their practices. This ensures your entire data ecosystem is aligned with the law, protecting both your customers and your business from some very expensive violations.

CCPA vs. CPRA: Answering Your Top Questions

Getting to grips with the differences between these two landmark privacy laws can feel a bit overwhelming. Let's clear up some of the most common questions business owners and marketers have about the shift from CCPA to CPRA and what it means for day-to-day operations.

Does CPRA Completely Replace CCPA?

No, it doesn't. A better way to think about it is that CPRA builds upon and strengthens the CCPA. The original CCPA is the foundation, and the CPRA is the major expansion built right on top of it.

Essentially, all the old rules from the CCPA still apply unless the CPRA specifically changed them. For compliance purposes, you're now following the CCPA as amended by the CPRA.

What Is the Biggest Change for Marketing Teams?

For marketers, the biggest game-changer is the new definition of "sharing" personal information, which specifically targets cross-context behavioral advertising. This puts a spotlight on common digital advertising tactics like retargeting campaigns and using third-party data to build custom audiences.

Under the CPRA, you have to give consumers a clear and easy way to opt out of this kind of data sharing. This means updating your cookie banners and privacy policies, and your "Do Not Sell My Personal Information" link now needs to read "Do Not Sell or Share My Personal Information."

What Is Sensitive Personal Information?

Sensitive Personal Information (SPI) is a brand-new category of data introduced by the CPRA, and it comes with much stronger protections. This includes things like Social Security numbers, precise geolocation, racial or ethnic origin, religious beliefs, genetic data, and health information.

The crucial new element here is that consumers gain a specific right to limit how businesses use and disclose their SPI. They can demand you only use it for the essential purpose of providing the product or service they asked for.

To comply, you'll need a separate and distinct link on your site for consumers to exercise this new right. This forces companies to conduct detailed data mapping and build entirely new internal processes to handle these limitation requests, adding a significant layer of operational complexity.

Is There Still a 30-Day Period to Fix Violations?

Not in the way there used to be. The CCPA gave businesses a mandatory 30-day "right to cure," which was a grace period to fix a violation after being notified and avoid a penalty. The CPRA changes this, making the cure period discretionary.

Now, the California Privacy Protection Agency (CPPA) gets to decide if a business deserves time to fix an issue, and they'll likely look at things like intent and how cooperative the business is. This shift raises the stakes considerably, pushing companies to be proactive about compliance instead of waiting to react to a notice.

Ready to understand your website traffic without compromising user privacy? **Swetrix** offers a powerful, privacy-first analytics solution that gives you actionable insights while staying compliant with regulations like GDPR and CPRA. Start your 14-day free trial today and see what you've been missing.